Mega trade and working capital finance technology trends: Episode 1 - Navigating the data maze of platforms

Explore the dynamic intersection of automation, data, and trade and supply chain finance platforms solutions in the ever-evolving economic landscape. Elena Sankova and Carlos Teixeira delve into the evolution of platforms and how banks are leveraging integrated platforms to enhance their trade finance offerings. Discover the imperative role of automations, the challenges faced by financial institutions, and the prospects of AI.

Platforms: why are automations imperative?

In this new mega trade and working capital trends series, Elena and Carlos unravel the intricate threads of economic platforms. As we navigate the present landscape and why platforms were created in the first place, we start with the different drivers at different points in time. Let’s first explore the pivotal role of automation. 56% of banks prefer to integrate fintech solutions via robust platforms, shaping their digital trade finance offerings from end-to-end. The quality of data and data automations are the baseline of platforms, but what exactly do these automations entail?

Detangling the data

Imagine the myriad data sets that surround banking platforms—sorting, analyzing, and decision-making based on actionable insights. Automation steps in as the orchestrator, seamlessly integrating technology across trade, supply chain, and financial institutions. But how do we manage these diverse drivers across different timelines?

The interconnected ecosystems

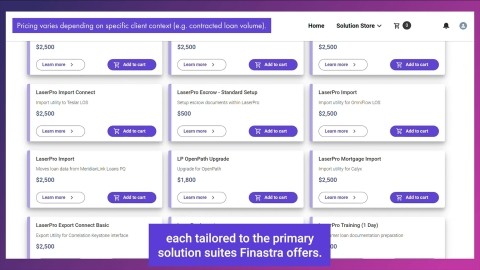

From software development kits, when banks owned and maintained the systems themselves, to workflow automation provided by third parties, banks are actively consuming and experiencing these types of platforms / banks became the consumer of these platforms. The benefits? Simplified processes, embracing seamless consumption and stepping up fast in the top banks' arena.

The rapid growth of AI

Looking forward to 2024 and beyond — AI and GenAI permeate every industry, including the lending sector. But AI’s power and efficiency relies on the quality of data. Yet, AI promises to automate, enhance interoperability, and elevate decision-making.